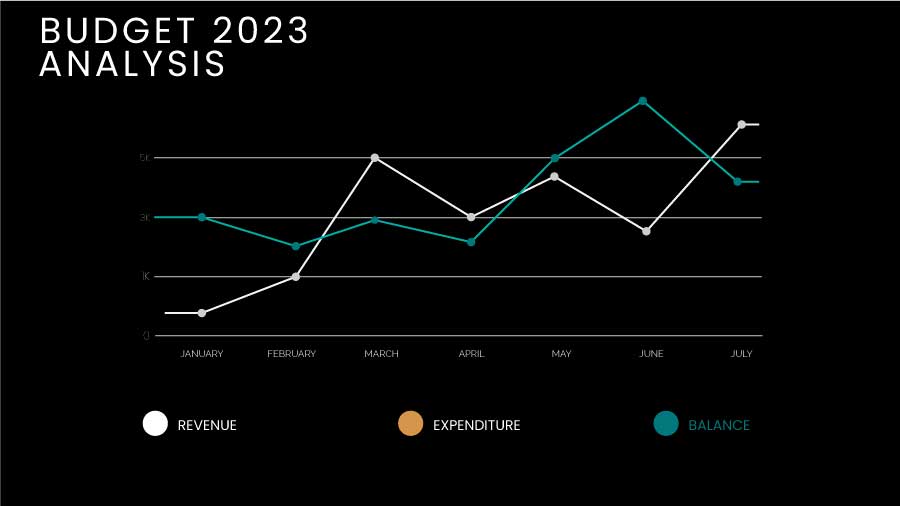

Budget 2023

We have had a budget bought down that forecasts a surplus. It is a budget for a lucky country with rivers of royalty gold pouring into the coffers of the Federal Government care of a commodities boom that hasn’t been handicapped by a currency at parity with the USD as the commodity boom at the time of Wayne Swan’s budgets were.

Lightning has struck twice with a low exchange rate when commodities are paid for in USD and a world awash with worldwide economic stimulus pumping up the demand for the resources our country has in such abundance.

It has meant that the country’s finances have avoided being jammed between relentless clamour for greater expenditure which the Labor Government couches in terms of equity and fairness and the dire state of the balance between Government revenues and expenditures which economists and analysts routinely describe as in structural deficit.

Revenues falling persistently short of expenditures barring abnormal circumstances that have saved us this year.

The discussion surrounding the budget by analysts, including economists, and pundits in the media has revolved around whether macroeconomic policy should be tilted towards combatting inflation or assuaging the hardship of various groups.

The common refrain from groups who want more revolves around an attack on the forthcoming stage 3 tax cuts while on the other side of the divide are the defenders of the tax cuts who say that if they are not implemented, they will continue to be a disincentive to work and a hand brake on productivity.

This is a debate that is couched in a static narrative. It is a belief that this is as good as it gets and the task is to divide the spoils. There is a chronic lack of debate regarding what should be done to make the economy more dynamic so that the pie can grow bigger through domestic efforts rather than the serendipity showered on Australia by the rest of the world’s demand for our resources.

There is an area of economics called microeconomics that offers an array of options ripe for choosing that can boost Australia’s income and wealth. They are written about extensively in the recently released 5 -year Productivity Inquiry report called Advancing Prosperity.

In fact, there is no shortage of reports and studies that have outlined multiple recommendations that will enhance the prosperity of this country. We routinely ignore them.

The reason is that their implementation is not without an initial cost. They are like an investment in the workings of our country, and, like any real investment, they mean a current sacrifice for a future benefit. We appear to no longer have the stomach for this trade-off.

Instead, the talk is about a different trade-off. It is about a ‘balance’ between the competing priorities. It requires continually shuffling between the different groups that are seeking help, or, in more laypeople’s terms, a handout.

Until we grasp the nettle of the microeconomic reforms that raising productivity requires, we will undertake a fool’s errand pretending that we can solve our various problems by enlarging the agenda of governments.

If you want to look at the latest manifestation of this ‘balance’, you simply have to listen to the argument currently raging about the recent budget, whether it is inflationary or prudent.

Here’s a tip: it’s no longer the war in Ukraine or the Covid Pandemic. It is us. We have shirked reform for nearly two decades and the result is we have hit capacity constraints in so many areas.

- If you are a business, the staff is hard to get hold of.

- If you are a household, the increasing cost of living is causing living standards to slip.

- If you are a government, you keep borrowing money to meet recurrent needs whenever you are not in the commodity boom.

There is one institutional stabiliser that is trying to keep it all in balance and that is the Reserve Bank. Until the silly decision kicks in, whereby it is given the responsibility of overseeing full employment as well as maintaining price stability, it will focus on what it does best. That is maintaining price stability.

While the unemployment rate is low, it will look at the current situation calmly and come to the only conclusion it can.

Nominal interest rates are lower than the inflation rate, so monetary settings are still stimulatory.

There is very little slack in the economy.

There is nothing in government policy that is aimed at removing stimulus.

The upward leg of the interest rate cycle has not yet ended. Trying to predict when it will is a fool’s errand. Even the experts keep getting that wrong.

Wedded to this is the damage done to the middle class over nearly 3 decades that has placed a widening gap between the haves and the have-nots. Driven mostly by the expense of accommodation and the pressure this has placed on households.

In a liberal democratically based economy like ours, these imbalances tend to self-correct. The problem is they do it in a savage manner.

Although here in my article I have written about the budget 2023 as I see it, I am wise enough to realise that other acclaimed analysts have their own opinions. Kate Ainsworth, a business reporter recently published on ABC News, her overview of the 2023 Australian Budget. In my opinion, it is worth a read.

2 Responses